Improving Content & Interaction to Decrease First Payment Default

A quick-turnaround design exploration, yielding multiple viable solutions that were AB tested to increase decision confidence for the customer, address compliance issues, decrease first payment defaults by 15-20%, and increase predicted net revenue by 7.6%.

Role

Lead Product Designer

Collaborators

Content Designer; Product Manager; Engineering team; Legal & Compliance team

Methodologies

UX Design; UI Design; Content Design & Direction; Heuristic Analysis; Live Experimentation; Stakeholder Buy-in

What to Expect

Overview – Define the Problem, Goals, By the Numbers

Define the Problem

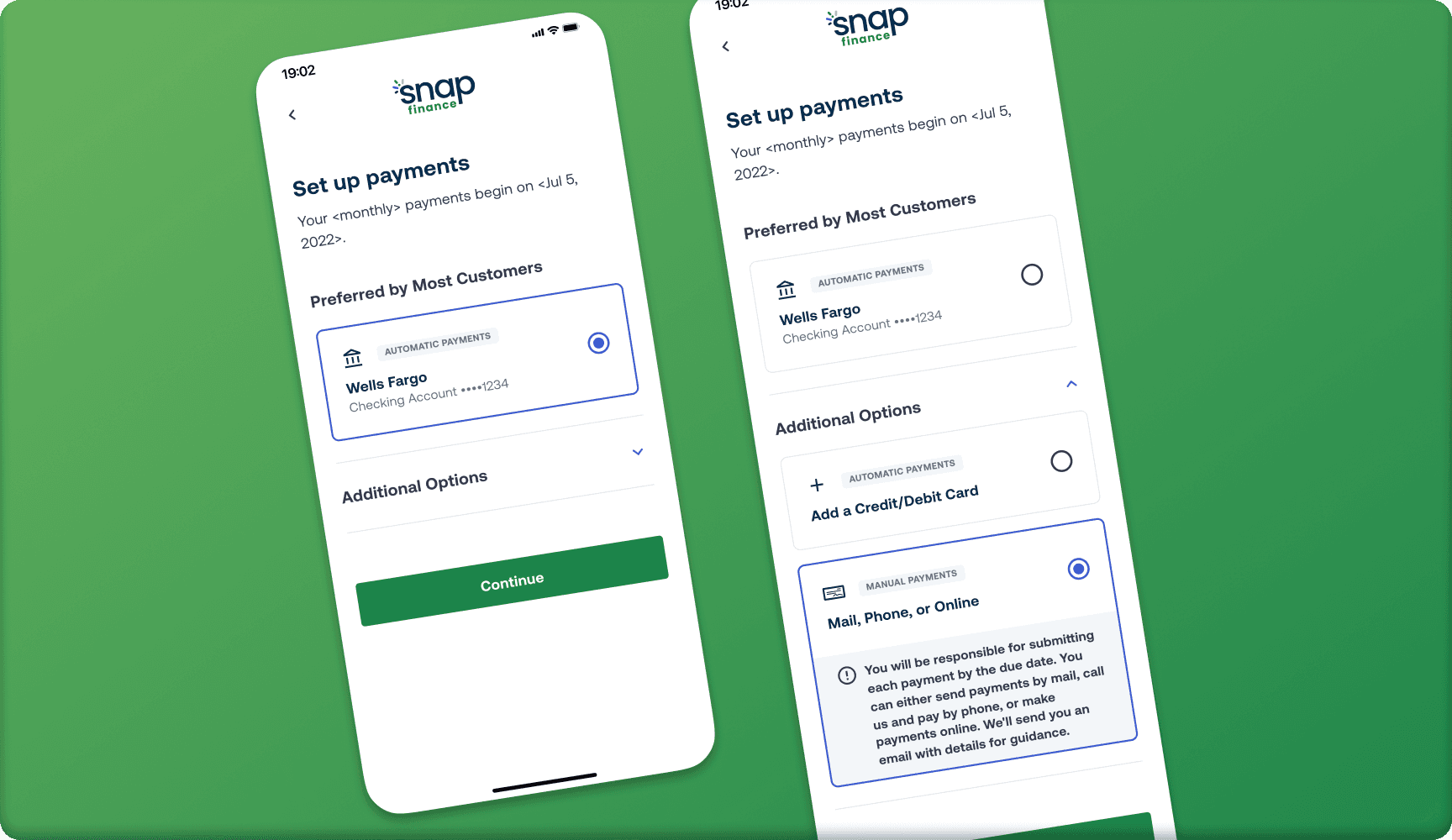

After being approved for loan financing with Snap Finance, the customer needs to choose the type of payment plan they want to be on – automatic or manual – before signing their agreement and purchasing the item.

There were very strict compliance regulations in place for the presentation of these choices, which the old experiences did not exactly meet.

Customers who chose manual payments also tended to have a higher rate of first payment default, which negatively affected both corporate revenue and the customer’s credit.

A new bank financier was about to partner with Snap, but had issue with this part of the flow, so I was tasked with coming up with some new options.

Goals

Focus on this single step in the E2E flow

I had previously explored ways to streamline the 3 separate payment steps in this flow

Company did not want to invest engineering resources for the multi-touchpoint E2E fix

Ensure compliance & regulations are followed

Automatic and manual options cannot seem “favored” in their presentation

Options must be presented directly to customer on their device, not on the merchant device

Drive a higher number of “automatic payment” selections, which should result in lower first payment default rates overall

Increase customer comprehension and decision confidence in order to decrease the amount of post-flow payment plan changes

Requires calling into Call Center, costing the company money and customer frustration

By the Numbers

-15.6%

Decrease in First Payment Defaults (automatic)

-20.0%

Decrease in First Payment Defaults (manual)

+7.6%

Increase in Predicted

Net Revenue

5

Design Solutions

Presented

3

Design Solutions

Tested

1

Design Solution

Released

Design Exploration

The existing customer-facing payment selection screen had it’s share of problems, including information overload and lack of context or education regarding the options.

In usability session for another project, customers told us they generally would just use the same payment method for all 3 payment prompts throughout the flow (I led another initiative to streamline this), treating this all as a “single purchase.” But IRL, they were choosing “Pay manually later” because it seemed easier and more flexible, unfortunately resulting in higher rates of missed payments.

Starting with Pencil and Paper

As a quick turnaround project, I shared 5 solutions with the team the next day, and we narrowed it down to 3 to experiment with.

It was a rewarding measure of success to see the team debate so strongly between the 3 viable solutions.

One design goal I kept in mind was “transparency” – we wanted to ensure the customer understood their increased responsibility when choosing “manual,” while trying to encourage them to choose “automatic” without being manipulative.

The 5 Initial Options

In addition to the regular 3-in-a-box teammates (design, product, engineering), we brought in Legal for the initial review to make sure we were being compliant before moving forward.

Most of my options share a pattern I had been introducing throughout the E2E experience – showing additional contextual information upon selection of a card.

Live Experimentation & Outcome

With 3 options approved by Legal and the team split over which would perform best, the true decision maker would be the customer via live ABC testing.

Based on the data, the decision was made to push the “Focused” option to 100%.

The decrease in first payment default rates for the same plan type was an unexpected positive for the customer and the business.

Hypotheses

Adding intentional friction by interacting with the accordions, tabs, or groupings caused customers to pause and evaluate the choices more than when presented with a straight list

Social proof seemed reassuring to the customer

Focus on the payment method (bank) over type (auto vs manual) seemed to have made the choices easier

Customer interviews backed this up – customers view this all as a single transaction and would use the same payment method for this and the other 2 payment steps

Describing the manual payment method (via phone or mail) was less enticing than “pay later”

First Payment Default Rates (over control)

-6.5%

Automatic Payments

-5.8%

Manual Payments

-15.6%

Automatic Payments

-20.0%

Manual Payments

+1.3%

Automatic Payments

+9.1%

Manual Payments

Predicted Net Revenue (over control)

+3.2%

+7.6%

-2.2%

Automatic Payment Selection Rates (over control)

-27.0%

+5.7%

+2.4%

Payment Plan Change Rates (over control)

-36.7%

-38.4%

-82.7%