Overview

As the Lead Product Designer at Snap Finance, I was responsible for driving the 0-to-1 design of their first consumer mobile app, spanning account servicing, originations (financing application), store finder tool, and Auth experiences. I oversaw UX & UI strategy and execution, from leading usability research sessions and defining interaction patterns to collaborating closely with product and engineering partners to ensure alignment and quality.

I directly contributed to shaping and prioritizing product and design roadmaps and backlogs, led a cross-functional workshop and a discovery research session to identify pain points and areas of opportunity to enhance the experience and drive KPIs, helped develop a new brand language, and spearheaded the adoption of Snap’s first design system, Mercury.

Role

Lead Product Designer

Collaborators

4 Product Managers; 2 Product Owners; 6 Engineering teams; Legal & Compliance; Marketing

Methodologies

UX

UI

Content

Prototyping

Usability Research

Live Experimentation

Stakeholder Buy-in

Heuristic Analyses

Workshops

Roadmap Prioritization

Company

Snap Finance is a decade-old BNPL lease-to-own and loan financing company serving more than 3M customers, with a focus on helping consumers who do not qualify for traditional financing afford larger living expenses and durable goods. In 2024, Snap financed more than $1B, with a revenue of nearly $250M.

Challenge

The legacy web presence for the financing application process and account servicing was disjointed and cumbersome (on both the front- and back-ends). Customer login to the account servicing experience hovered in the single digits, negatively affecting trust and re-engagement.

The primary goals with launching the new mobile app were to increase trust and transparency via improved access to account servicing and repayments, increase both new and returning customer application submissions, and unify Snap’s cross-channel brand with a new, engaging visual presence.

Requirements & Goals

Start delivering 0-to-1 designs within 3 months on the job

Target a soft launch for existing customers and account servicing

Look & feel

Evolve and contribute to two rebrands

Drive adoption of their first global design system

Account servicing dashboard

Solve for access to in-progress applications and increased repeat applications

Reduce call center reliance for basic tasks

Repayments flow

Reduce error triggers

Increase payment submissions

Originations flow

Reduce dropoffs and time on task

Auth & login

Simplify and standardize

Key Metrics – Year One

500k

Downloads

+38%

Increase in payments

over web

17k

Unique weekly active users

+52%

Application submission rate

improvement over web

4.9⭐

App Store rating

-64%

Application submission time

reduction for return customers

Best Overall FinTech Mobile App

FinTech Breakthrough Awards 2025

Auth & Login

The Challenge

How might we guide the 3 existing customers types to their intended task(s) when they land on the home screen?

Initial Exploration

I began by wireframing the PM-directed login experience via the home screen, based on existing customer types and legacy backend architecture.

Without access to discovery research at this point, I relied on heuristic analysis to uncover multiple customer pain points and technical constraints.

–

–

–

–

Requires user to understand internal architecture and nomenclature, causing frustration

“Apply” entrypoint does not check for returning customers, creating a cumbersome experience and potentially reducing submissions

Separate entrypoints lead to different task and path access for the same user, causing click avoidance and confusion

No way for logged in customers to continue an application or apply again, reducing submissions

Iteration 1

To solve for the above issues, I proposed:

Merging Returning Customer & Returning Applicant entrypoints to a single “Log In”, reducing confusion and increasing additional submissions by 32%

Creating a hub & spoke login model that drove the development of the backend “Determine Endpoint,” balancing a smarter experience with technical constraints

Building a portable “Verification Module” to check the database, for a customer record match, then show a prefilled application, reducing application submission time by 64% (~5 minutes)

Iteration 2

Post-launch, InfoSec discovered a potential security risk by surfacing account validity based on a standalone email input.

My 3-in-a-box team addressed this during a late-night session, adding a short-term bandaid fix: email OTP step

Solves the security concern but makes the experience more cumbersome for the customer

I uncovered feedback from the call center that Returning Applicants (w/out accounts) were confused on how to access their in-progress applications.

I had to reverse my previous streamlined proposal and bring back the 3rd entrypoint to “Continue an Application,” virtually eliminating these calls

Home

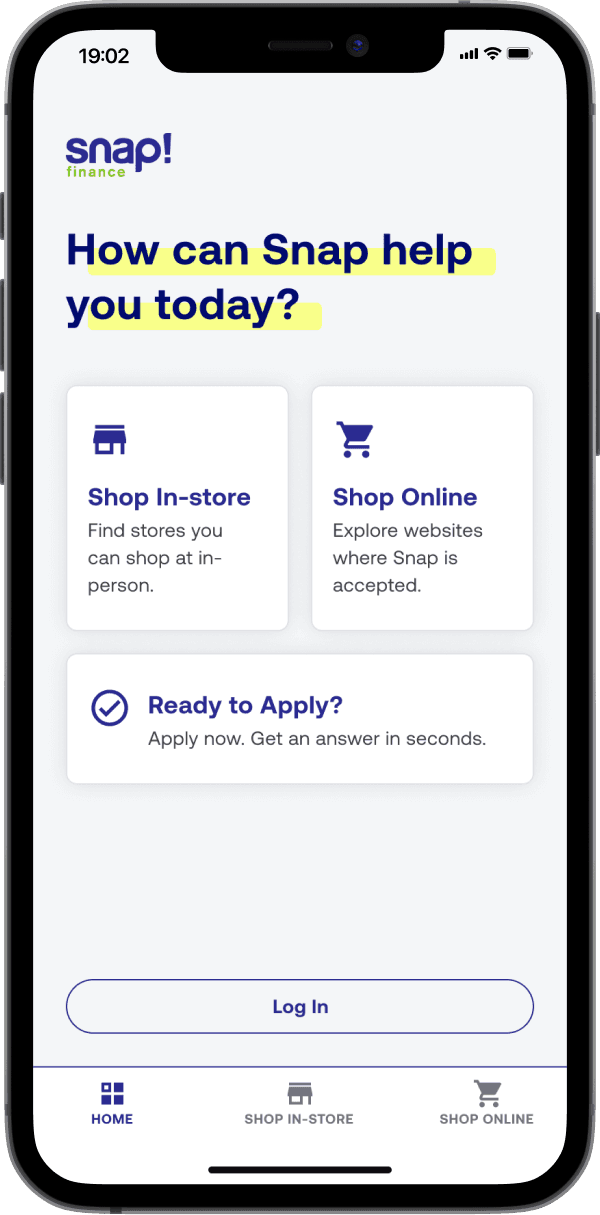

Initial Exploration

With the UX framework in place, UI for the Home screen was asked to be delivered prior to designing any other pages.

Focus on new customer acquisition and driving originations (application submissions)

Evolve the first of 2 pre-launch corporate rebrands, combined with legacy UI components

+

–

–

–

–

Usability testing showed no navigation issues, but mainly focused on logged in account servicing

Very dry and utilitarian

Corporate rebrand still in early stages, combined with legacy UI elements

Lack of educational or marketing messaging

Coding issues with proposed headline “highlight” effect

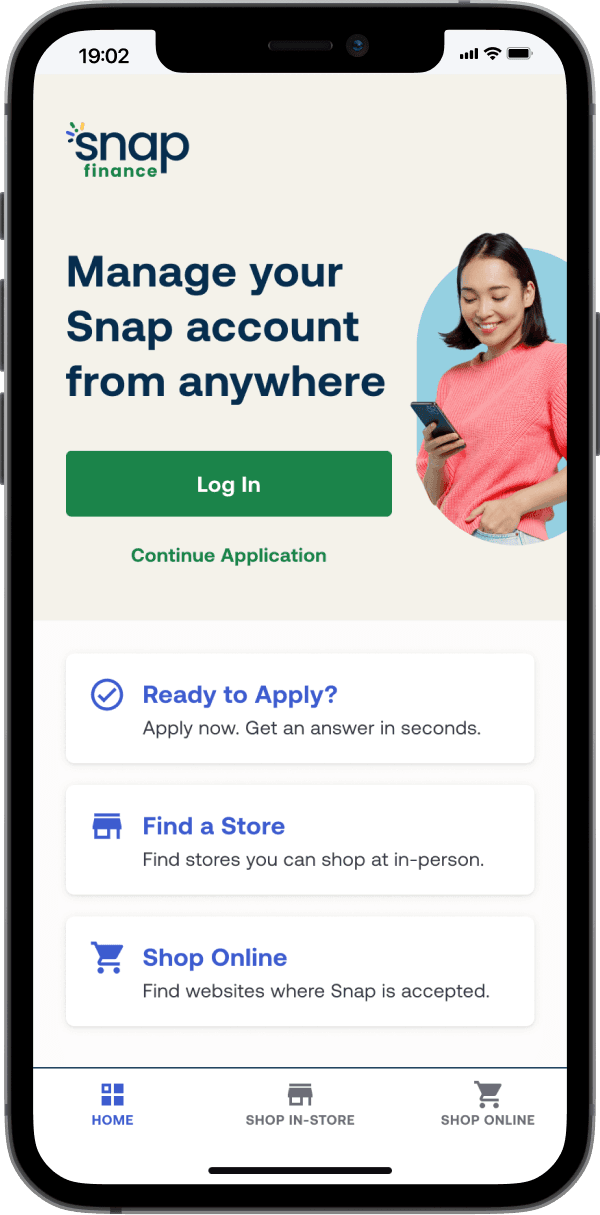

MVP Released Solution

Multiple last minute pivots surfaced just prior to launch.

Product focus shift to “soft launch” for Existing Customers & Account Servicing, from new customer acquisition

I created a new headline and redesigned Hero section

Reintroduced the 3rd entrypoint to “Continue an Application”

I uncovered feedback from the call center that Returning Applicants (w/out accounts) were confused on how to access their in-progress applications

The 2nd of 2 corporate rebrands and a new brand language was introduced

Working with the new Creative Director, I concepted a new brand treatment using models in the “sprinkle” shape pulled from the new logo

Snap’s first official design system, Mercury, was adopted

My VP nicknamed me the “Godfather of the Design System” for evangelizing and getting leadership buy-in to invest resources, while collaborating with Engineering on execution and approach

Design Evolution for .Com Home

I redesigned the Web & mobile web Home screen to be more cohesive with the new brand language, focusing on new customer acquisition and originations.

+

+

+

–

–

Increased .com application starts by +5.5%

Social proof has been shown to be effective in past projects

More cohesive cross-platform branding

Some customers were confused by carousel-like design as a shopping category selector

Experimentation on mobile app was not pursued

Financing Application Flow

Applying Best Practices & Industry Experience

Instead of a straight copy over to mobile app, I took the opportunity to enhance the legacy web flow with the goals of improving clarity, reducing time on task, and increasing submission rates.

Mobile app application submission rate saw a 52% improvement over web

Showing a prefilled application to known/previous customers reduced time on task from over 7 minutes to 2.5 minutes (64% improvement)

Pain points addressed from legacy web flow

–

–

–

–

–

Customer has to read through 3 to 4 pieces of repetitive content before getting to interactive forms

Progress meter was unhelpful because flow length could change depending on responses

Horizontal navigation buttons caused issues in longer languages

Disabled primary CTA caused usability issues

Language toggle not discoverable buried at bottom of screen

Takeaways

I was able to onboard quickly to my new role at Snap Finance, learn the core product structure and business model, and start delivering designs for most sections in the app within the first 3 months.

Make sure all stakeholders are involved – the earlier the better! Don't assume that because something is functioning one way today means it has been vetted and approved.

Visuals can go a long way in bringing the team together. I was in many early requirements meetings that kept going in circles, so I decided to start screensharing Figma as I would live wireframe what an SME was describing. This helped get conversations unstuck and move us forward together.

What's Next

More testing and diving further into optimizing the Originations flow. I led a cross-functional workshop that uncovered quick- and long-term enhancement roadmap items in the E2E flow. One of which was the Approval screen, which showed some of the highest drop off rates. I led a redesign and live experiment of this screen that improved application completion rates, leading to an increase of $30M in annual funding.

I worked on a Northstar framework proposal to redesign the Home page of the app, which gained a lot of support with leadership while socializing, but needs to get in front of customers to really get dialed in and find areas for improvement. I would love to share this project in a live presentation.